Are you seeking for 'customs valuation thesis'? You will find the answers here.

Table of contents

- Customs valuation thesis in 2021

- Example of thesis statement

- Transaction value method philippines

- Deductive value method example

- Computed value method

- Narrative essay thesis statement

- Price actually paid or payable

- Wto valuation agreement

Customs valuation thesis in 2021

This image shows customs valuation thesis.

This image shows customs valuation thesis.

Example of thesis statement

This picture demonstrates Example of thesis statement.

This picture demonstrates Example of thesis statement.

Transaction value method philippines

This picture representes Transaction value method philippines.

This picture representes Transaction value method philippines.

Deductive value method example

This image illustrates Deductive value method example.

This image illustrates Deductive value method example.

Computed value method

This picture illustrates Computed value method.

This picture illustrates Computed value method.

Narrative essay thesis statement

This picture demonstrates Narrative essay thesis statement.

This picture demonstrates Narrative essay thesis statement.

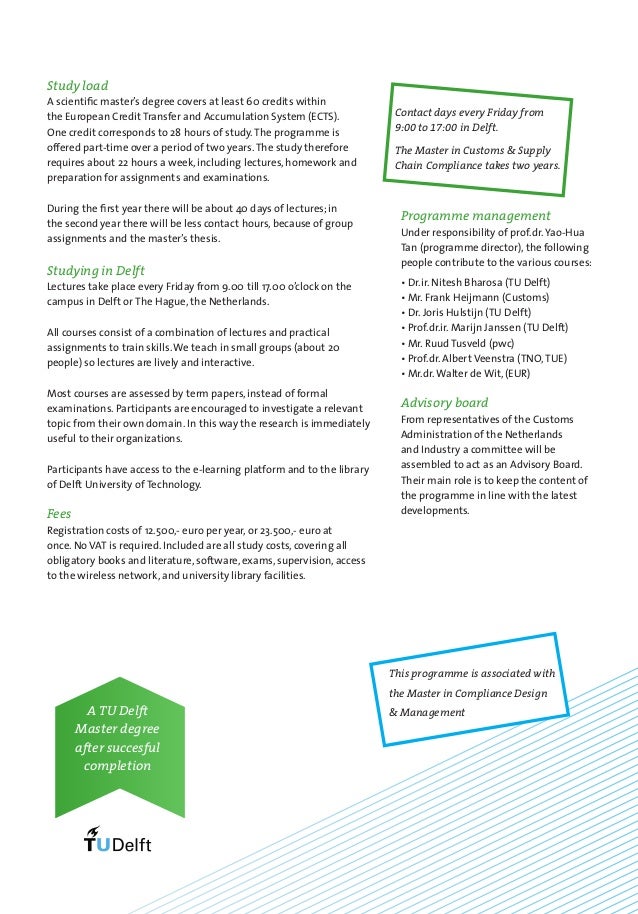

Price actually paid or payable

This image demonstrates Price actually paid or payable.

This image demonstrates Price actually paid or payable.

Wto valuation agreement

This picture illustrates Wto valuation agreement.

This picture illustrates Wto valuation agreement.

When do you need to do a customs valuation?

Customs valuation is used to determine the value of goods when they are being entered into the various customs procedures eg. import, export, warehousing and processing under customs control. The customs value is essential to determine the correct amount of any customs duty to be paid on imported goods.

Why is the WTO Agreement on Customs Valuation important?

The WTO agreement on customs valuation aims for a fair, uniform and neutral system for the valuation of goods for customs purposes — a system that conforms to commercial realities, and which outlaws the use of arbitrary or fictitious customs values.

How does estimating the value of a product at customs work?

For importers, the process of estimating the value of a product at customs presents problems that can be just as serious as the actual duty rate charged.

Last Update: Oct 2021